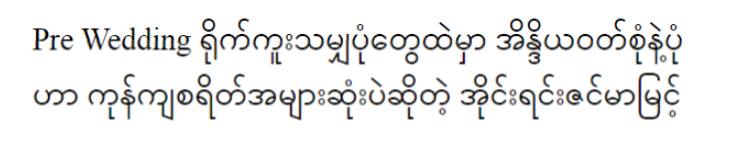

In an era where technology permeates every aspect of our lives, it comes as no surprise that the financial industry is undergoing a significant transformation. One of the most groundbreaking developments in recent years has been the rise of robo-advisors – automated investing solutions that leverage algorithms to manage investment portfolios. But what does the future hold for these digital financial advisors? How will they continue to revolutionize the way we invest our money? Let’s delve into the exciting prospects and potential challenges that lie ahead for The Future of Robo-Advisors: Automated Investing Solutions.

Enhanced Personalization: Tailoring Investments to Individual Needs

One of the key trends shaping The Future of Robo-Advisors: Automated Investing Solutions is the focus on enhanced personalization. Traditional investment advisors often provide cookie-cutter solutions that may not align with the unique financial goals and risk tolerance of individual investors. However, robo-advisors have the capability to analyze vast amounts of data and customize investment strategies to meet the specific needs of each client.

Utilizing Machine Learning Algorithms for Precise Recommendations

Machine learning algorithms lie at the heart of robo-advisors, powering their ability to analyze market trends, assess risk, and make investment decisions. As these algorithms continue to evolve and improve, robo-advisors will become even more adept at generating precise recommendations tailored to the financial objectives and preferences of investors. By leveraging advanced data analytics, robo-advisors can identify patterns and opportunities that may not be apparent to human advisors, resulting in more effective portfolio management.

Integration of Behavioral Finance Principles to Optimize Investor Behavior

Another exciting development in The Future of Robo-Advisors: Automated Investing Solutions is the integration of behavioral finance principles into the decision-making process. Understanding how emotions and cognitive biases influence investor behavior is crucial for optimizing investment outcomes. Robo-advisors can leverage insights from behavioral finance to encourage disciplined investing habits, mitigate irrational decision-making, and ultimately, enhance long-term returns for investors. Through features such as automated rebalancing and goal-based investing, robo-advisors can help clients stay on track towards their financial goals, regardless of market volatility or external pressures.

Expansion of Services Beyond Traditional Investing

As robo-advisors continue to evolve, we can expect to see a significant expansion of services beyond traditional investing. While these platforms initially gained traction for their ability to provide low-cost, automated portfolio management, they are now branching out into areas such as retirement planning, tax optimization, and even banking services. By offering a comprehensive suite of financial products and tools, robo-advisors aim to become the go-to solution for all aspects of personal finance.

Incorporating ESG Criteria into Investment Strategies

Environmental, Social, and Governance (ESG) investing has gained considerable momentum in recent years, with investors increasingly seeking opportunities to align their portfolios with their values. Recognizing this trend, many robo-advisors are now incorporating ESG criteria into their investment strategies. By allowing clients to invest in companies that prioritize sustainability and ethical practices, robo-advisors are catering to a growing segment of socially conscious investors. This not only reflects a commitment to corporate responsibility but also presents an opportunity for investors to generate positive social and environmental impact alongside financial returns.

Integration of Financial Wellness Tools to Empower Investors

Financial wellness is about more than just managing investments; it encompasses various aspects of financial health, including budgeting, debt management, and goal setting. Recognizing the importance of holistic financial planning, robo-advisors are increasingly integrating financial wellness tools into their platforms. These tools provide users with insights into their overall financial picture, helping them make informed decisions and take proactive steps towards achieving their long-term objectives. By empowering investors to take control of their finances and build a solid foundation for the future, robo-advisors are poised to become indispensable partners in their journey towards financial success.

Navigating Regulatory Challenges and Technological Risks

Despite the tremendous potential of robo-advisors, their widespread adoption also presents certain challenges and risks that must be addressed to ensure their continued success.

Navigating Regulatory Landscape and Compliance Requirements

As robo-advisors gain prominence in the financial industry, regulators are paying closer attention to ensure that these platforms operate in accordance with existing laws and regulations. Compliance requirements vary across jurisdictions, posing a significant challenge for robo-advisors seeking to expand their global footprint. Navigating the complex regulatory landscape requires robust compliance frameworks and ongoing dialogue with regulatory authorities to ensure transparency and accountability. Failure to comply with regulatory requirements could not only result in financial penalties but also damage the reputation and credibility of robo-advisors.

Mitigating Cybersecurity Risks and Data Privacy Concerns

The increasing reliance on technology also exposes robo-advisors to cybersecurity risks and data privacy concerns. As custodians of sensitive financial information, robo-advisors are prime targets for cyber attacks and data breaches. A security breach not only jeopardizes the integrity of client data but also undermines trust in the platform’s ability to safeguard personal information. To mitigate these risks, robo-advisors must implement robust cybersecurity measures, such as encryption, multi-factor authentication, and regular security audits. Additionally, they must ensure compliance with data protection regulations to uphold the privacy rights of their clients and maintain trust in The Future of Robo-Advisors: Automated Investing Solutions.

As we look ahead to The Future of Robo-Advisors: Automated Investing Solutions, it’s clear that these digital financial advisors will continue to play a prominent role in shaping the landscape of personal finance. With their emphasis on enhanced personalization, expansion of services, and commitment to regulatory compliance, robo-advisors are well-positioned to meet the evolving needs of investors in an increasingly complex and dynamic market environment. By leveraging the power of technology and data analytics, robo-advisors have the potential to democratize access to professional investment advice and empower individuals to achieve their financial goals with confidence. However, navigating regulatory challenges and mitigating technological risks will be essential to ensure the long-term viability and trustworthiness of robo-advisors as they pave the way for a more accessible, efficient, and inclusive financial ecosystem.