Bear markets can be intimidating, even for seasoned investors. Watching your portfolio shrink while negative headlines dominate the news can leave you feeling powerless. But here’s the good news: bear markets, while challenging, are also an opportunity. With a smart strategy and a calm mindset, you can come out stronger on the other side. Let’s dive into how you can not just survive but thrive during a bear market.

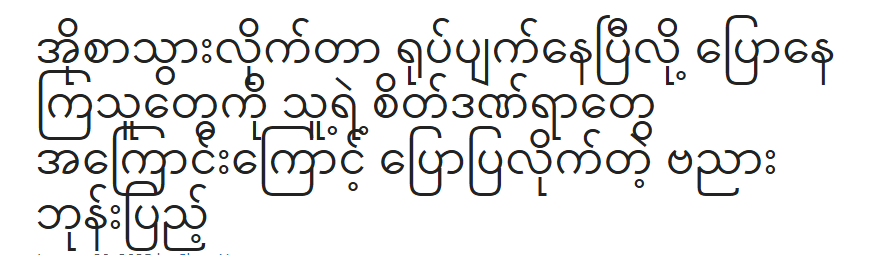

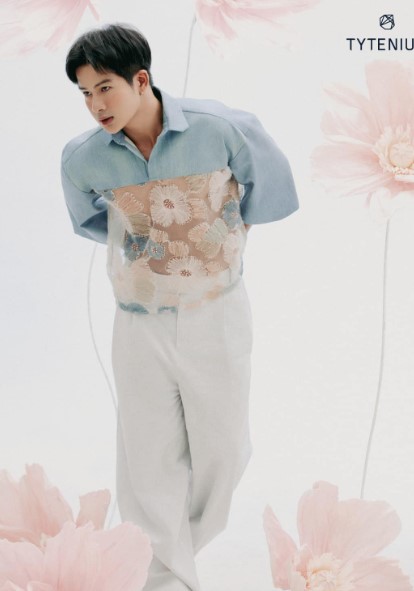

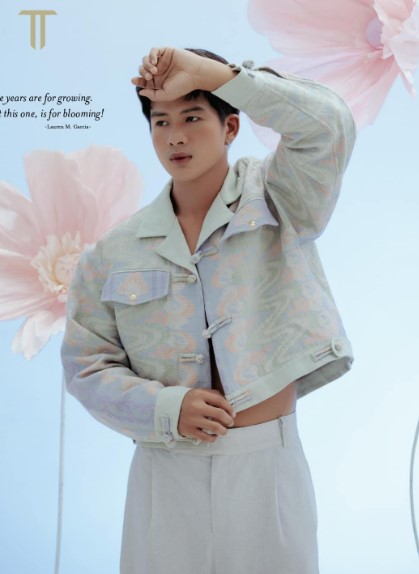

H1: What Is a Bear Market?

H2: Understanding the Basics

A bear market occurs when stock prices drop by 20% or more from recent highs, often sparked by economic slowdowns, rising interest rates, or geopolitical events. Essentially, it’s a period of widespread pessimism in the markets.

H2: Bear Market vs. Bull Market

If bull markets are the financial equivalent of sunny skies, bear markets are their stormy counterpart. While bull markets focus on growth and optimism, bear markets reflect caution and contraction.

H1: Why Bear Markets Are a Natural Part of Investing

H2: Historical Perspective

Bear markets might feel catastrophic in the moment, but history shows that they’re temporary. Markets always rebound, often hitting new highs after a downturn.

H2: Opportunity in Disguise

Think of a bear market as a clearance sale for stocks. While others are selling out of fear, it’s your chance to invest in quality assets at discounted prices.

H1: The Psychology of Bear Markets

H2: Why Fear Is the Biggest Threat

When markets fall, emotions like fear and panic can cloud judgment. Making impulsive decisions often leads to locking in losses rather than riding out the storm.

H2: Staying Rational Amidst the Noise

Remember: headlines are designed to grab attention, not offer sound investment advice. Stay focused on your long-term goals instead of reacting to short-term volatility.

H1: Tips for Smart Investing in a Bear Market

H2: Stick to Your Plan

Investing without a plan is like driving without a map. A clear strategy—whether it’s based on diversification, asset allocation, or long-term goals—will guide you through turbulent times.

H2: Dollar-Cost Averaging

This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. By doing so, you’ll buy more shares when prices are low and fewer when prices are high, reducing the impact of market fluctuations.

H2: Focus on Quality Stocks

Bear markets reveal which companies are resilient and which are fragile. Focus on buying stocks from established companies with strong fundamentals, like consistent cash flow and low debt.

H1: Diversification: Your Best Defense

H2: Spread the Risk

Don’t put all your eggs in one basket. Diversifying across sectors, asset classes, and even geographies can help mitigate losses during a downturn.

H2: Include Defensive Assets

Add defensive investments, such as bonds, dividend-paying stocks, or gold, to your portfolio. These assets tend to perform better or hold steady when markets decline.

H1: Think Long-Term, Not Short-Term

H2: Avoid Market Timing

Trying to predict the market’s bottom is a risky game. Instead, focus on the bigger picture. Historically, long-term investors who stay the course during bear markets are rewarded when the market rebounds.

H2: Reevaluate Your Goals

A bear market is an excellent time to reassess your financial goals. Are you saving for retirement? A home? Knowing your objectives can help you maintain perspective.

H1: The Power of Dividends in a Bear Market

H2: Reliable Income Stream

Dividend-paying stocks can provide a steady income even when stock prices are falling. Reinvesting these dividends during a bear market can amplify your returns over time.

H2: Focus on Dividend Aristocrats

These are companies that have consistently increased their dividend payouts for decades. They’re often more stable and less affected by market downturns.

H1: Avoid Common Mistakes in Bear Markets

H2: Don’t Sell in Panic

Selling your investments during a downturn locks in losses. Instead, take a deep breath, revisit your strategy, and remind yourself that markets recover.

H2: Avoid Over-Leveraging

Using borrowed money to invest can amplify losses during a bear market. Stick to what you can afford to lose without jeopardizing your financial health.

H1: Preparing for the Next Bull Market

H2: Position Yourself for Recovery

Bear markets are temporary, and bull markets always follow. By investing wisely during a downturn, you’ll be better positioned to capitalize on the recovery.

H2: Lessons Learned

Take notes on what worked and what didn’t during the bear market. Use these lessons to refine your strategy for the future.